ASLI’s strategic priorities reflect a holistic and inter-connected approach to the work that we do.

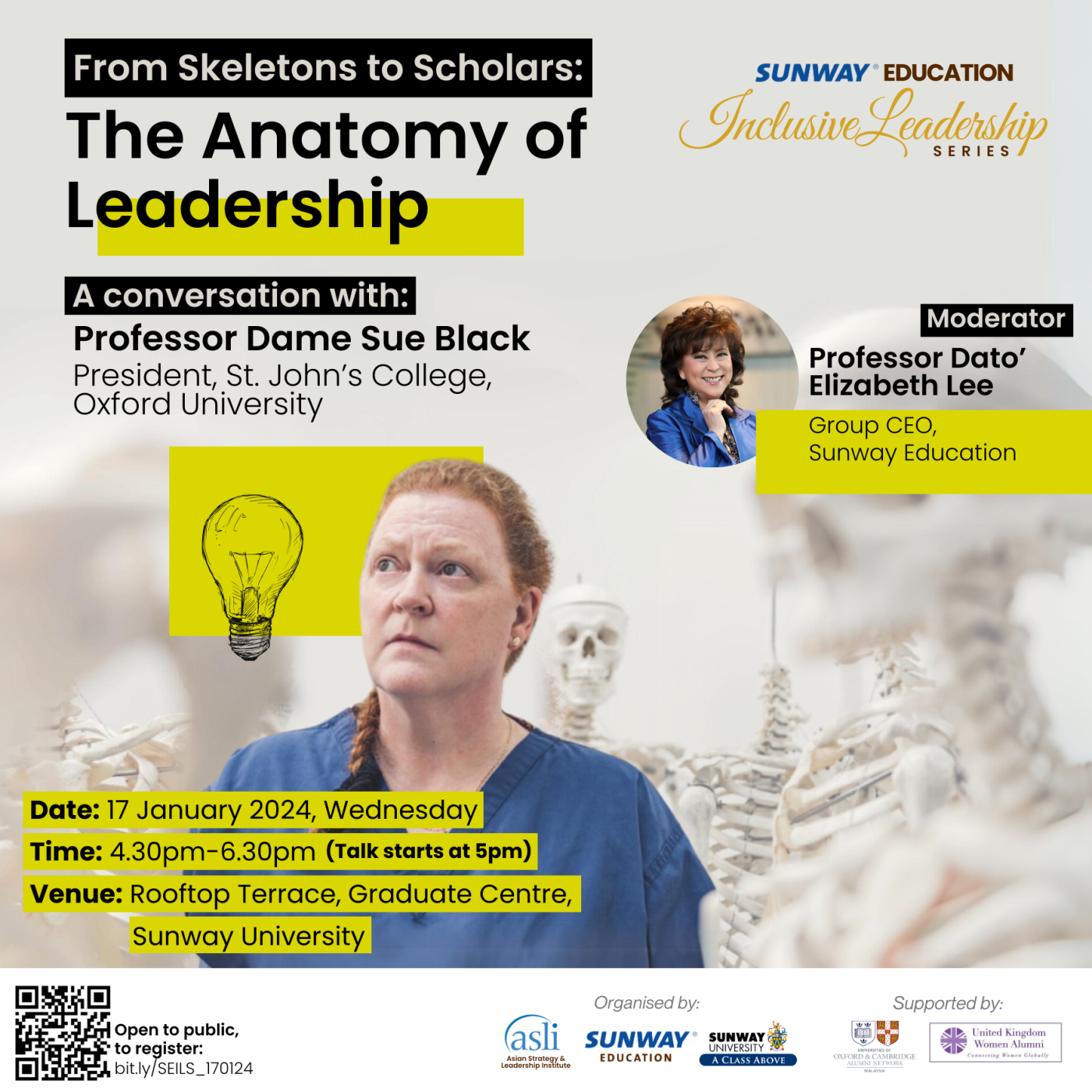

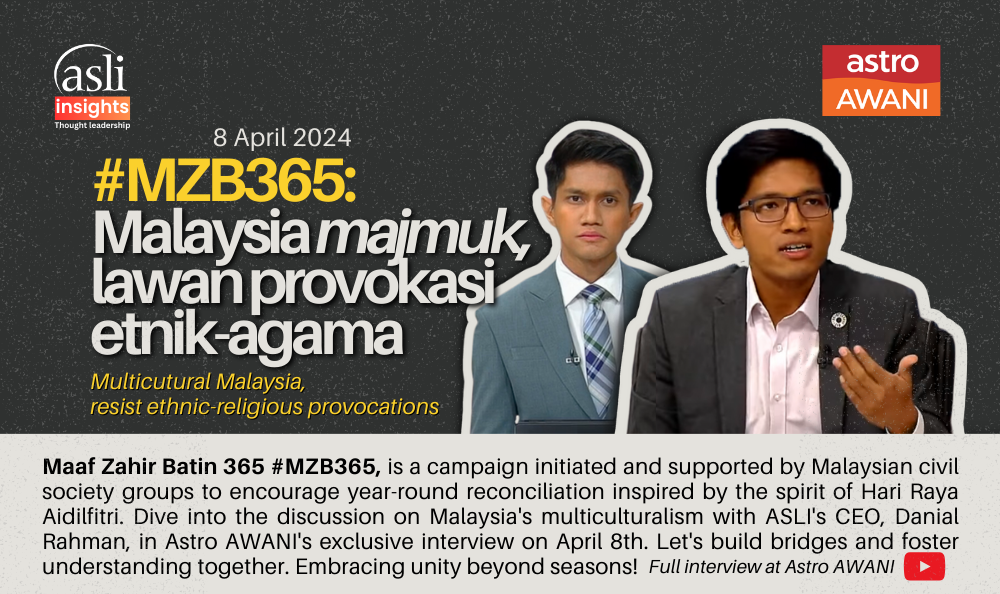

Promoting Leadership & Advancing ESG Principles

Harnessing Artificial Intelligence & Technology for Societal Wellbeing

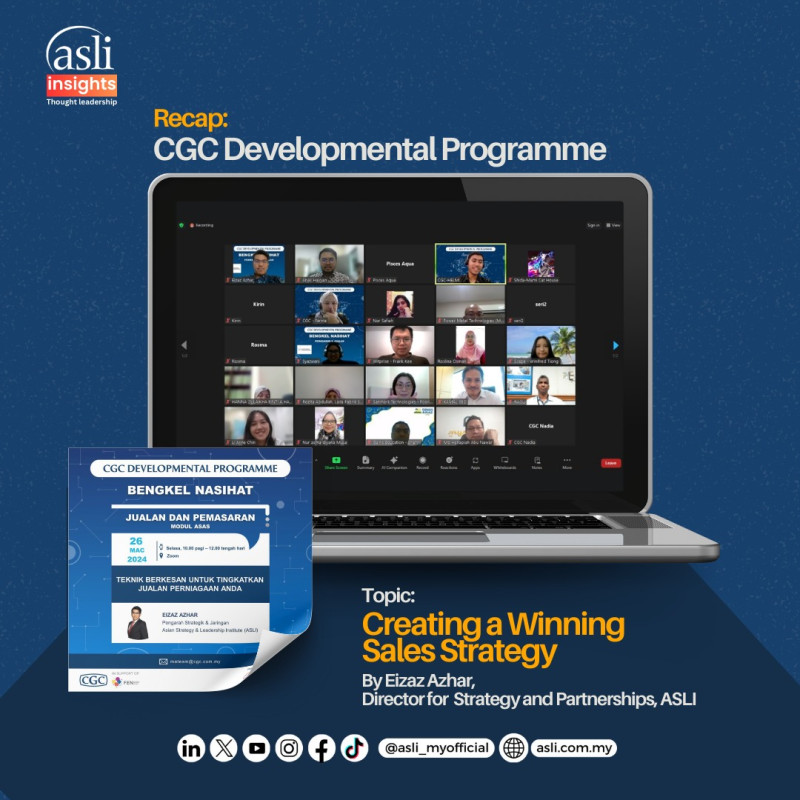

Providing Knowledge, Lifelong Learning & Skills Education

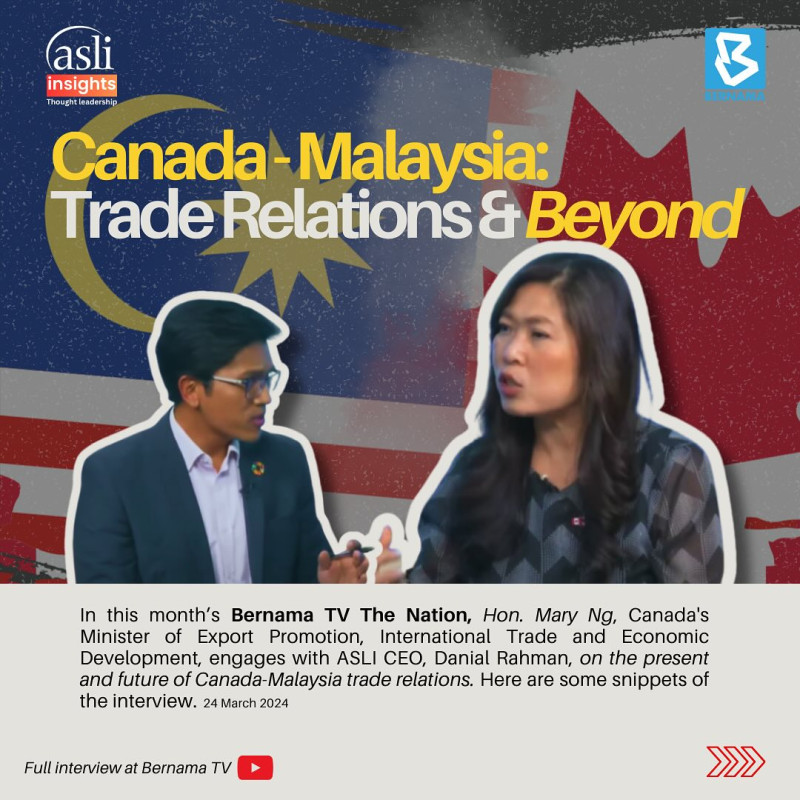

Strengthening Regional Dialogue, Trade & Cooperation

Enhancing Community Care, Economic Opportunity & Wellbeing

Events & Conferences

20 March 2024

|

2:00pm - 4:00pm

JC2 Auditorium, Level 1, Sunway University, Malaysia

29 January 2024

|

4:30pm - 6:30pm

Rooftoop Terrace, Graduate Centre, Sunway Unviersity

17 January 2024

|

4:30pm - 6:30pm

Rooftoop Terrace, Graduate Centre, Sunway Unviersity

Leadership & Training

ASLI Insights